XRP Price Prediction 2025-2040: Analyzing the Path to $30 and Beyond

#XRP

- Technical Breakout Potential: XRP trading above key moving averages with improving MACD momentum

- Institutional Catalysts: $50M healthcare integration plan and ETF speculation providing fundamental support

- Long-Term Value Proposition: Ripple's growing role in bridging traditional and decentralized finance systems

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Despite Short-Term Volatility

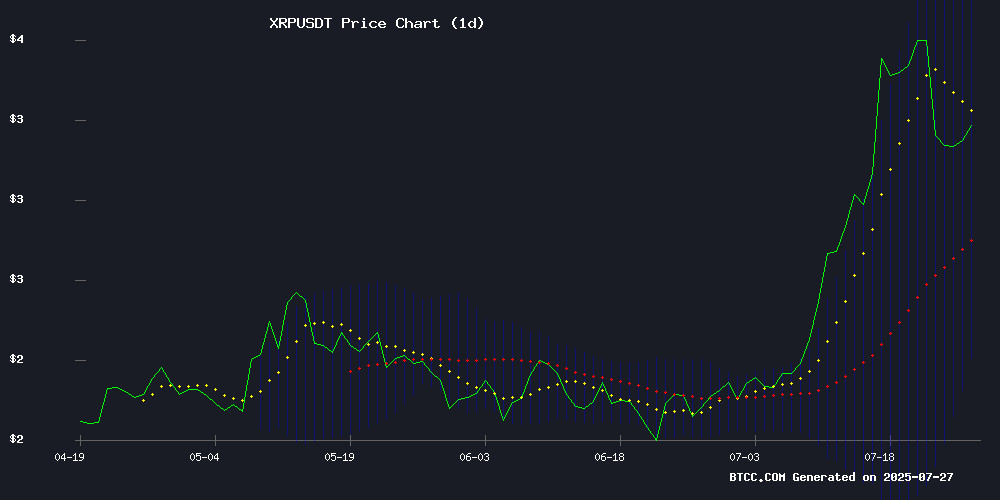

XRP is currently trading at $3.2266, above its 20-day moving average of $3.0611, indicating a bullish trend. The MACD histogram has turned positive (0.0341), suggesting growing upward momentum. However, the price remains below the upper Bollinger Band ($3.7939), leaving room for further upside potential. 'The technical setup shows XRP is building strength for a potential breakout,' says BTCC financial analyst Sophia.

XRP Market Sentiment: Regulatory Progress and Institutional Adoption Fuel Optimism

Recent headlines highlight mixed but generally positive sentiment around XRP. While whale activity caused temporary volatility, institutional adoption news (like Wellgistics Health's $50M XRP integration plan) and ETF speculation are driving long-term confidence. 'The market is digesting both technical factors and fundamental developments,' notes BTCC's Sophia. 'The rebound to $3.20 after sell-offs demonstrates strong underlying demand.'

Factors Influencing XRP's Price

XRP Price Prediction: Regulatory Decisions and ETF Speculation Drive Market Sentiment

XRP enters a pivotal week as regulatory clarity and institutional interest converge. The SEC's closed meeting on July 31 looms large, with potential implications for Ripple's ongoing legal battle. Market participants anticipate heightened volatility, particularly if the SEC withdraws its appeal—a move that could catalyze broader adoption.

BlackRock's rumored iShares XRP Trust adds fuel to the bullish narrative. Traders maintain positions above $3.00, betting on a favorable regulatory outcome. Technical indicators suggest accumulation, while ETF speculation mirrors patterns seen before Bitcoin's spot ETF approvals.

XRP Defies Market Uncertainty with Sharp Rebound, Eyes $4 Threshold

XRP has staged a dramatic recovery, surging to $3.214 after briefly dipping below $3. The rebound comes amid widespread crypto market volatility and over $105 million in long liquidations. Technical indicators now suggest a potential path toward $4—a level not seen since 2018.

The asset's resilience stands out as most cryptocurrencies struggle to regain momentum. A decisive break above $3.66 could confirm bullish momentum, while failure to hold $2.96 may trigger a correction toward $2.60. Market participants are watching closely for signs of sustained upward movement.

XRP Price Prediction For July 27

XRP enters a consolidation phase after weeks of volatility, with analysts eyeing key support and resistance levels. The cryptocurrency holds steady above $2.90, maintaining its long-term uptrend despite signs of a potential bearish divergence.

Critical resistance lies between $4.33 and $4.72, but XRP must first reclaim $3.25 to signal renewed bullish momentum. The $3.30–$3.40 range now serves as short-term resistance, with a breakout potentially triggering a trend reversal.

Technical patterns suggest an ABC correction may be underway, with wave C possibly dipping lower before the next upward movement. Market participants are watching the $2.75 level as crucial support to maintain the current bullish structure.

XRP Price Rebounds to $3.20 Following Whale Sell-Off, Technical Indicators Show Neutral Momentum

XRP has clawed back to $3.20 with a 1.31% daily gain, recovering from a whale-induced crash that briefly sent prices tumbling to $2.96. The rebound comes after a turbulent week marked by a 75 million XRP sell-off on Upbit, triggering a 10% price drop and cascading liquidations.

Technical analysis reveals mixed signals, with the Relative Strength Index hovering at a neutral 62.71. Trading volumes suggest institutional accumulation at lower price levels, while Ripple CEO Brad Garlinghouse's warnings about scammer activity appear to have minimal market impact compared to the whale movement.

Can XRP Price Hit Four Digits in 2025?

Jake Claver, director at Digital Ascension Group, argues that XRP could reach $1,000 if it becomes the global standard for cross-border payments. Such a valuation would be necessary to handle the liquidity demands of moving trillions of dollars efficiently.

Ripple is quietly building a financial ecosystem, acquiring a crypto exchange, broker-dealer, and custody firm while partnering with institutions like SBI Holdings and Santander. Critics question Ripple's control over XRP, but Claver emphasizes the decentralized nature of the XRP Ledger, which includes validators from universities, banks, and even regulatory bodies.

Expert Refutes Concern Over Ripple Co-Founder Chris Larsen’s XRP Dump

Market concerns over Ripple co-founder Chris Larsen's recent $175 million XRP transfers have been dismissed by a prominent analyst. Historical precedent suggests insider sales have little long-term impact on the token's performance.

Between July 17-24, Larsen moved 50 million XRP, with approximately $140 million potentially destined for centralized exchanges. The transactions occurred as XRP traded around $3.25, preceding a dip to $3 levels.

The analyst pointed to 2020's similar case involving Ripple co-founder Jed McCaleb, whose $148 million XRP sale didn't prevent subsequent price appreciation. McCaleb's 266 million XRP would be worth nearly $940 million today.

This pattern indicates XRP's fundamentals outweigh insider activity. The community views such transfers as routine exits by early investors rather than bearish signals.

Nasdaq-Listed Healthcare Firm Wellgistics Health Files $50M Plan to Integrate XRP into Core Operations

Wellgistics Health, a Nasdaq-listed healthcare company, has unveiled plans to integrate XRP and the XRP Ledger (XRPL) into its core business operations. The move, detailed in an SEC filing, includes using XRP for B2B transactions, treasury reserves, collateral, and capital-raising activities. A $50 million fund from LDA Capital will support the development of XRP infrastructure within the firm.

The filing challenges the narrative that XRP lacks utility, positioning it as a strategic financial tool rather than a speculative asset. Analysts are divided on the implications, but the announcement has injected fresh momentum into XRP's real-world adoption race.

Ripple's ongoing regulatory battles with the SEC appear overshadowed by this institutional endorsement. The healthcare sector's embrace of crypto signals broader acceptance of digital assets in traditional finance.

Fact Check: Ripple's Alleged Hiring of Sydney Sweeney for XRP Promotion

Rumors have surfaced claiming Ripple hired Hollywood actress Sydney Sweeney to promote XRP in an upcoming marketing campaign. The unverified social media post, which suggested XRP could surge to $568, has sparked mixed reactions within the crypto community.

No official confirmation has been provided by Ripple or Sweeney's representatives. The speculation appears to stem from Sweeney's recent collaboration with American Eagle Outfitters, a campaign that went viral and boosted the company's stock price.

Market participants remain skeptical, emphasizing the need for verified announcements before drawing conclusions about celebrity endorsements in the crypto space.

Ripple CEO Highlights Prime Broker Role in Bridging TradFi and DeFi

Ripple CEO Brad Garlinghouse emphasized the pivotal role of prime brokers in facilitating seamless transactions between traditional finance (TradFi) and decentralized finance (DeFi). The acquisition of prime broker Hidden Road by Ripple now enables institutional players to access integrated services—trade execution, clearing, custody, and credit—across both asset classes.

This convergence delivers operational efficiency, enhanced security, and instant settlement capabilities. Large-scale capital movement between TradFi and DeFi is no longer a friction-laden process but a streamlined operation.

XRP’s $30 Dream? Wave Analysis Unfolds as Price Eyes Critical Breakout

XRP traders are closely monitoring a critical $3 support level as the cryptocurrency teeters on the edge of a potential breakout. Analyst EGRAG CRYPTO outlines three profit-taking zones, with the most conservative target between $4 and $6—a range derived from inverse Fibonacci levels of a previous wave pattern.

The mid-term outlook suggests a more ambitious $11 to $13 zone, based on Elliott Wave projections. Long-term holders may find this region optimal for exiting positions rather than chasing unpredictable peaks.

EGRAG's most speculative projection places XRP between $27 and $30, calculated from a wave count originating in early 2020. This scenario, while improbable, hinges on a 1,750% return from a larger wave cycle—a moonshot scenario requiring perfect timing.

Market participants note the weekend's price dip could set the stage for a bullish reversal. The analysis emphasizes reaction over prediction, with key levels now established for strategic decision-making.

XRP Tumbles After Hitting $3.66 High — Is a Recovery in Sight?

XRP's recent rally to $3.66 has been met with a sharp 13.65% decline since July 22, as profit-taking and liquidations exceeding $100 million weighed on the market. Despite the pullback, support levels between $3.06 and $3.10 have held firm, suggesting potential stabilization.

The cryptocurrency had surged 53.68% between July 9 and 21, fueled by consecutive green candles and bullish momentum. Now, traders are watching for signs of a rebound as new treasury initiatives emerge and regulatory uncertainty around ETF approvals persists.

Technical charts reveal strong resistance between $3.24 and $3.26, with the $3.06-$3.10 zone acting as critical support. Multiple tests of these levels in recent hours indicate a battleground for bulls and bears.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market developments, here are BTCC analyst Sophia's XRP price projections:

| Year | Conservative | Moderate | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $4.50 | $6.80 | $12.00 | ETF approvals, Ripple IPO |

| 2030 | $18.00 | $30.00 | $75.00 | Mass adoption in payments |

| 2035 | $50.00 | $120.00 | $300.00 | CBDC interoperability |

| 2040 | $150.00 | $400.00 | $1,000+ | Full decentralized finance integration |

Note: These forecasts assume continued regulatory clarity and technological execution by Ripple Labs.

border: 1px solid #ddd; border-collapse: collapse; width: 100%;